Are you making the right choices when it comes to a commercial property loan? Deciding on the best financing option can be the turning point for your business or investment. From interest rates to loan terms and everything in between, this guide will offer useful insights into securing the loan that aligns with your objectives.

Key Takeaways

-

Commercial property loans are more complex than residential loans and include various types, each with unique features that will suit different business needs. It’s not only about the rate.

-

Investing in commercial properties involves assessing potential returns, cash flow forecasting, and managing risks such as capital loss and liquidity constraints.

-

Successful commercial loan applications require thorough preparation, often including a solid business plan, financial forecasts, and detailed documentation.

-

Engaging a business finance broker can enhance the likelihood of getting your loan approved.

Understanding Commercial Property Loans

Commercial property loans, unlike residential property loans, are designed to finance the purchase of properties for business use or investment, known as commercial property purchase. They differ in significant ways, including:

-

Borrowing capacity

-

Loan terms and periods

-

Interest rates

-

Method of rental reviews

This means that dealing with commercial property loans is more complicated and complex than residential loans, due to a variety of factors specific to commercial lending. This is why a business finance broker can be a very beneficial resource for potential commercial property investors.

“These loans are often secured against business assets and are intended for specific business-related asset purchases. So, if you’re thinking about purchasing a commercial property, it’s crucial to understand the nuances of commercial property loans.” says Nadine Connell, Commercial Finance Broker at Smart Business Plans. This will help you navigate the complexities of the application process but also enable you to make the most out of your investment.

Types of Commercial Loans

Commercial loans are mainly categorised into asset and equipment loans, and commercial property loans. In Australia, various types of commercial loans are available to finance different types of commercial real estate projects and business ventures:

-

Commercial property loans

-

Commercial construction loans

-

Commercial investment loans

-

Commercial development loans

-

Commercial bridging loans

-

Equipment financing loans

-

Franchise finance loans

-

Invoice finance loans

These loans are tailored to meet the specific needs and requirements of commercial borrowers, offering flexibility in terms of loan amount, repayment terms, interest rates, and security requirements.

Each type of business loan in Australia has its own eligibility criteria, interest rates, fees, and repayment terms. Borrowers should carefully assess their financing needs and explore different loan options to find the most suitable financing solution for their commercial real estate projects or business ventures.

Different types of commercial loans will of course suit some borrowers more than others. That’s why working with a reputable commercial finance broker can help borrowers navigate the complexities of the commercial lending market and secure financing that meets their specific needs and objectives.

Commercial Property Loan Interest Rates

Interest rates for a commercial property loan, also known as commercial property interest rates, are influenced by several factors, including risk and loan period. Fixed-interest commercial mortgages are a common type of commercial property loan interest rate option. To procure a fixed-interest commercial mortgage, applicants typically require an acceptable credit score (an experienced business loan broker can get this information for you). The lower the risk perceived by the lender, the lower the interest rate you can expect.

Additional expenses such as commercial property valuations might also influence the overall cost of the loan for investors. It’s also worth noting that commercial bridge loans can serve as a short-term funding solution while investors wait for returns from another property sale. However, these loans may present high costs should there be any cash flow disruptions. Therefore, it’s essential to carefully consider all these factors when deciding on the type of commercial loan to apply for.

Evaluating Commercial Properties for Investment

When it comes to evaluating commercial properties for investment, the income capitalisation method is a valuable tool. This method calculates the valuation of a commercial property by analysing the profits it could yield, considering the current market conditions, expenses, and occupancy rates. This kind of analysis can provide a comprehensive understanding of a property’s potential returns, guiding your investment decisions.

However, it’s important to note that modifications in the income approach may be necessary if a property’s net operating income cannot be determined due to factors such as vacancies or lack of maintenance. In such cases, investors may need to employ alternative valuation methods or seek professional advice to ensure accurate property valuation.

Risks and Rewards of Commercial Property Investment

Investing in commercial property can yield substantial returns through both capital gains and rental income. Commercial properties often have longer leases, securing tenants for extended periods and providing income stability. Additionally, commercial property investment can add diversification benefits to an investor’s portfolio, spreading risk across different asset classes.

However, just like any investment, commercial property investment also carries risks. “Investors face the risk of capital loss if the value of commercial property investments decreases. Also, the liquidity of commercial property investments can vary, and some may offer limited liquidity events while others allow selling under favorable market conditions. Therefore, balancing the potential rewards against these risks is a crucial part of successful commercial property investment”, says Nadine Connell, Commercial Finance Broker at Smart Business Plans.

Cash Flow Considerations

When it comes to commercial property investments, managing cash flow is essential. Stable income streams from long-term leases to reliable tenants can lead to a higher valuation of properties and contribute to positive cash flow management. In addition, commercial tenants are often responsible for expenses like repairs and maintenance, which can reduce an investor’s overhead costs and positively affect cash flow.

Another strategy that investors can employ to manage cash flow is sale-leaseback transactions. These transactions involve selling the property and committing to a long-term lease back arrangement. This can provide immediate capital, although it ties the investor to a long-term lease. Understanding these cash flow considerations is crucial to managing a successful commercial property investment.

Is it difficult to get a loan for a commercial property?

Applying for a business loan requires thorough preparation. It necessitates preparing a solid business plan and providing an accurate cash flow forecast to showcase the business’s financial potential. These documents serve as a roadmap for your business, outlining its objectives, strategies, market analysis, and financial projections. They illustrate to lenders your business’s profitability and its ability to repay the loan.

A comprehensive commercial loan application must also include key documents such as:

-

Financial statements

-

Individual income proof

-

Bank statements

-

Identification

For start-ups, cash-flow projections and a business plan are also crucial.

Selecting the right type of commercial loan is equally important, and applicants must align their business needs with their borrowing capacity to craft a successful loan application.

The Role of a Business Finance Broker

A business finance broker can play an instrumental role in guiding you through the commercial loan process. They can:

-

Guide borrowers through the commercial loan application process

-

Assess eligibility

-

Recommend lenders

-

Assist with loan or lease applications

-

Increase your chances of application success by advising on loan selection, assessing borrowing power, and offering expert financial advice.

Brokers also provide the following services:

-

Managing the entire loan process from application to settlement, allowing business owners to concentrate on their business operations

-

Negotiating terms equitable for both parties, focusing on security, pricing, and loan covenants

-

Providing ongoing support after the loan is secured, helping with queries and business networking.

Therefore, working with an experienced commercial finance broker can make the commercial loan process smoother and more successful.

Documents and Information Required

A complete commercial loan application often consists of the following documents:

-

Business profile

-

Profit and loss statements

-

Personal financial statements

-

Information pertaining to collateral in the case of secured loans

These documents provide lenders with a comprehensive overview of your business’s financial health, enabling them to assess your repayment capacity and the risk associated with lending to your business.

Applicants must be prepared to present the following detailed financial documents:

-

Financial statements

-

Tax returns

-

Bank statements

-

Evidence of additional income

-

Depending on the nature of the business, trust deeds or company registrations may also be necessary

-

Cash flow projections

-

Business plan

These documents provide a detailed account of your business’s revenue, expenses, and overall financial performance, which lenders need to assess your loan application.

Commercial Loan Terms and Conditions

Commercial loan terms and conditions can vary greatly depending on the type of loan and the lender. For instance, commercial asset or equipment loans are typically shorter in duration, ranging from five to seven years. On the other hand, some commercial property loans can have terms extending up to 25 or 30 years, with repayment options that include either Principal & Interest or Interest-only payments.

It’s important to consider other potential factors such as any penalties for early repayment. Understanding the terms and conditions of your business loan is essential to managing your obligations effectively and avoiding potential penalties or charges.

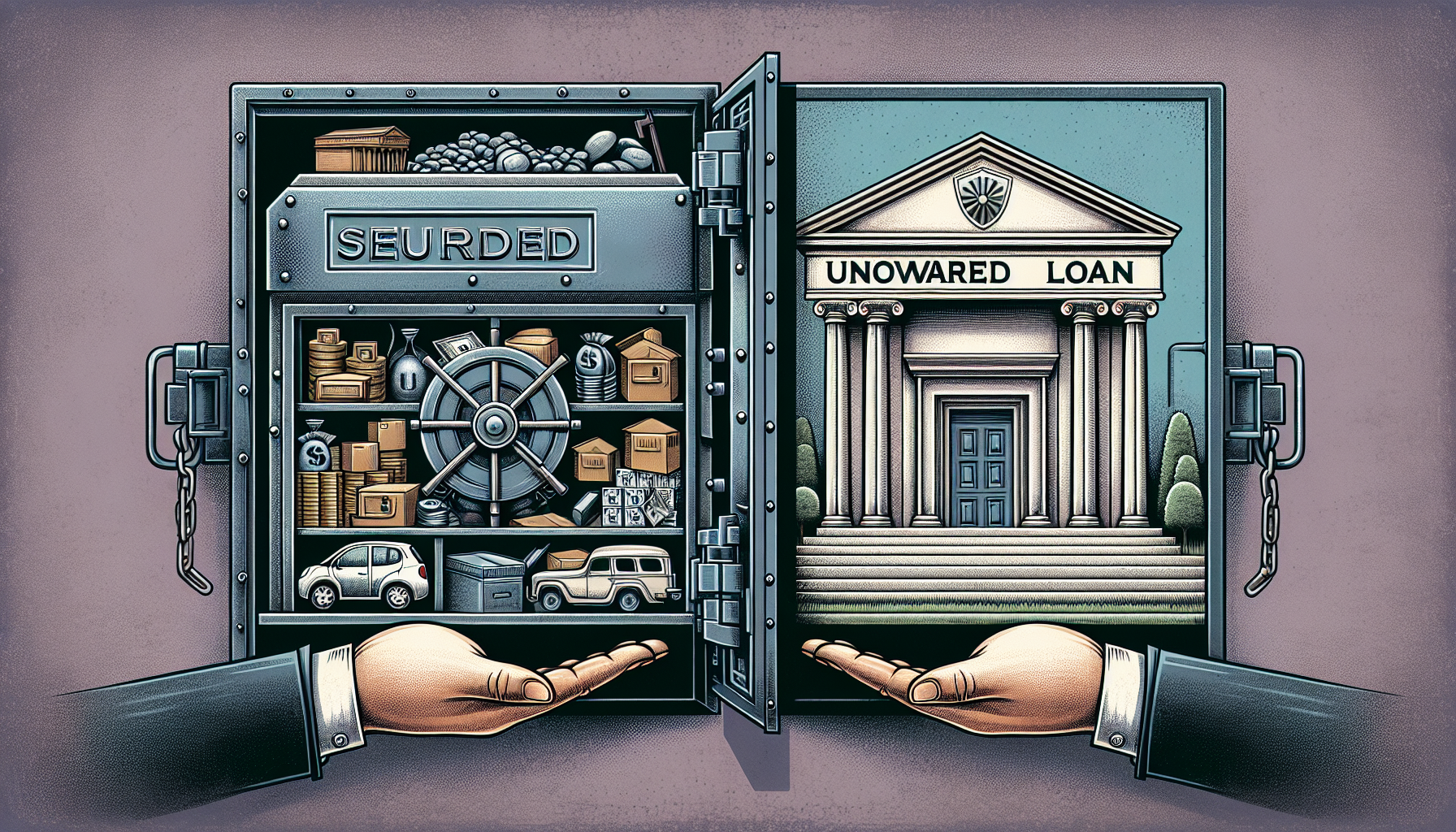

Secured vs Unsecured Loans

Secured commercial loans use assets such as property or inventory as a guarantee, offering lower interest rates and larger loan amounts. They entail a more rigorous approval process, as lenders need to assess the value of the collateral and the risk associated with the loan. On the flip side, unsecured commercial loans do not require physical assets as collateral, generally have a faster approval process with smaller amounts available, but result in higher interest rates to compensate for the increased lending risk.

The choice between secured and unsecured loans depends on various factors, including your business’s financial health, the availability of assets for collateral, and your tolerance for risk. While secured loans come with detailed terms and conditions and often necessitate thorough asset assessment and documentation, they offer the benefit of lower interest rates and larger loan amounts.

Conversely, unsecured loans offer quicker access to funds but come with higher interest rates due to increased lending risk.

If time is a factor, a commercial loan broker could be key in helping you secure the best terms while doing a lot of the hard work for you.

General Security Agreement (GSA)

A General Security Agreement (GSA) is an important document in the process of securing a commercial loan. It outlines the terms under which various assets of a borrower can be held as security for a loan —including:

-

property

-

plant equipment

-

vehicles

-

receivables

-

intellectual property

-

inventory

-

cash

-

investments

The GSA allows the lender to register a security interest on the Personal Property Securities Register (PPSR), giving them legal recourse in the event the borrower defaults on the loan.

Commercial loans with GSAs define specific terms that outline both the borrower’s and lender’s responsibilities, including:

-

Delivery of security

-

Obligations at default

-

Warranties

-

Rights to the collateral

-

Agreement termination conditions

Signing the GSA by the borrower is an acknowledgment of the provision of security for the loan, while the lender’s role includes registering their interest on the PPSR to secure their position.

Understanding the implications of a GSA is crucial before signing it as part of your commercial loan agreement.

Alternative Financing Options for Commercial Property

For potential investors who don’t meet typical bank loan criteria as they become stricter and interest rates increase, alternative financing options for commercial real estate are expanding. These options provide a broader range of avenues for businesses to secure the necessary funds for their commercial property investments. Some of these alternatives include:

-

Conduit loans

-

Private equity

-

Joint ventures

-

Crowdfunding

-

Mezzanine financing

Conduit loans serve as an alternative financing option for investors who may face difficulties with traditional loan applications, as these loans are pooled together and traded in secondary markets.

Other alternative financing options offer unique advantages that can make them attractive to certain types of investors. Understanding these options can help you choose the most suitable one for your specific needs and circumstances.

Pros and Cons of Alternative Financing

Alternative financing options come with their own set of benefits and risks. Some options to consider are:

-

Private equity and joint ventures: These offer the opportunity to invest in larger commercial property projects, sharing both the financial burden and the risks involved.

-

Crowdfunding for commercial real estate: This exposes investors to shared risk, with the advantage of low entry costs and broad accessibility.

-

Mezzanine financing: This provides a compromise of debt and equity that can offer flexible repayment options, but typically comes with higher interest rates.

Consider these options carefully to determine which one best suits your needs and risk tolerance, especially if you’re considering a higher risk investment.

However, while joint ventures allow shared decision-making, they can also lead to potential conflicts, and the complex negotiation process may not suit all investors. Investors in crowdfunding initiatives may have to relinquish a significant degree of decision-making and could experience challenges with liquidity. Also, alternative financing options like REITs are susceptible to market volatility which can lead to fluctuating investment values and uncertainty. Thus, it’s crucial to weigh the pros and cons of each alternative financing option before making a decision.

Working with an experience commercial property finance broker can help you weight up your options.

Choosing the Right Financing Solution

Choosing the right financing solution requires a thorough analysis of the business’s profitability and cash flow. Short-term financing solutions, like bridge loans or lines of credit, are typically used to support immediate operational needs such as inventory or receivables. In contrast, long-term financing solutions, such as mortgage loans, are used for larger investments like property acquisition or significant equipment purchases.

It’s important for businesses to align their financing choice with their current stage in the business life cycle and to consider how the financing will support the business’s projected growth and development.

A business needs to assess its unique needs, which can often be accomplished with a business plan, considering whether the financing is required for short-term operational costs or for long-term investments, and then select the financial product that offers terms that best meet those specific needs.

Summary

Commercial property loans are an essential tool for businesses looking to grow and expand. Understanding the intricacies of these loans, from the types available to the interest rates and terms, can help you make informed decisions that maximize your business’s potential. Evaluating commercial properties for investment requires careful consideration of potential returns, risks, and cash flow management strategies.

Working with an experienced business finance broker can significantly simplify the loan application process, increasing your chances of success. Choosing the right financing solution, whether it’s a traditional commercial loan or an alternative financing option, requires thorough analysis of your business’s financial health, cash flow, and specific needs. With the right knowledge and guidance, you can navigate the complexities of commercial property financing and unlock your business’s full potential.

Frequently Asked Questions

What is a commercial property loan?

A commercial property loan is specifically designed to help finance the purchase of properties for business use or investment, offering different terms and borrowing capacity compared to residential property loans.

What are the different types of commercial loans?

The different types of commercial loans include asset and equipment loans, as well as commercial property loans, each offering unique benefits based on the borrower’s requirements and situation.

What factors influence commercial loan interest rates?

The primary factors that influence commercial loan interest rates are risk and loan period. Additional expenses, such as commercial property valuations, may also impact the overall cost of the loan.

What are the risks and rewards of commercial property investment?

Investing in commercial property can offer significant potential gains through rental income and increasing property value, but it also involves the risk of capital loss and liquidity challenges.

How can a business finance broker help with a commercial loan application?

A business finance broker can assist with a commercial loan application by providing guidance, recommending lenders, and offering expert financial advice, ultimately increasing the chances of application success.