Brisbane’s commercial property market is entering the 2nd half of 2025 with strong momentum and balanced growth across industrial, retail, and office sectors. I’ve been watching the south-east corridor especially closely, and the numbers tell a story of confidence, resilience, and some new opportunities on the horizon.

Industrial: Southside Sets the Pace

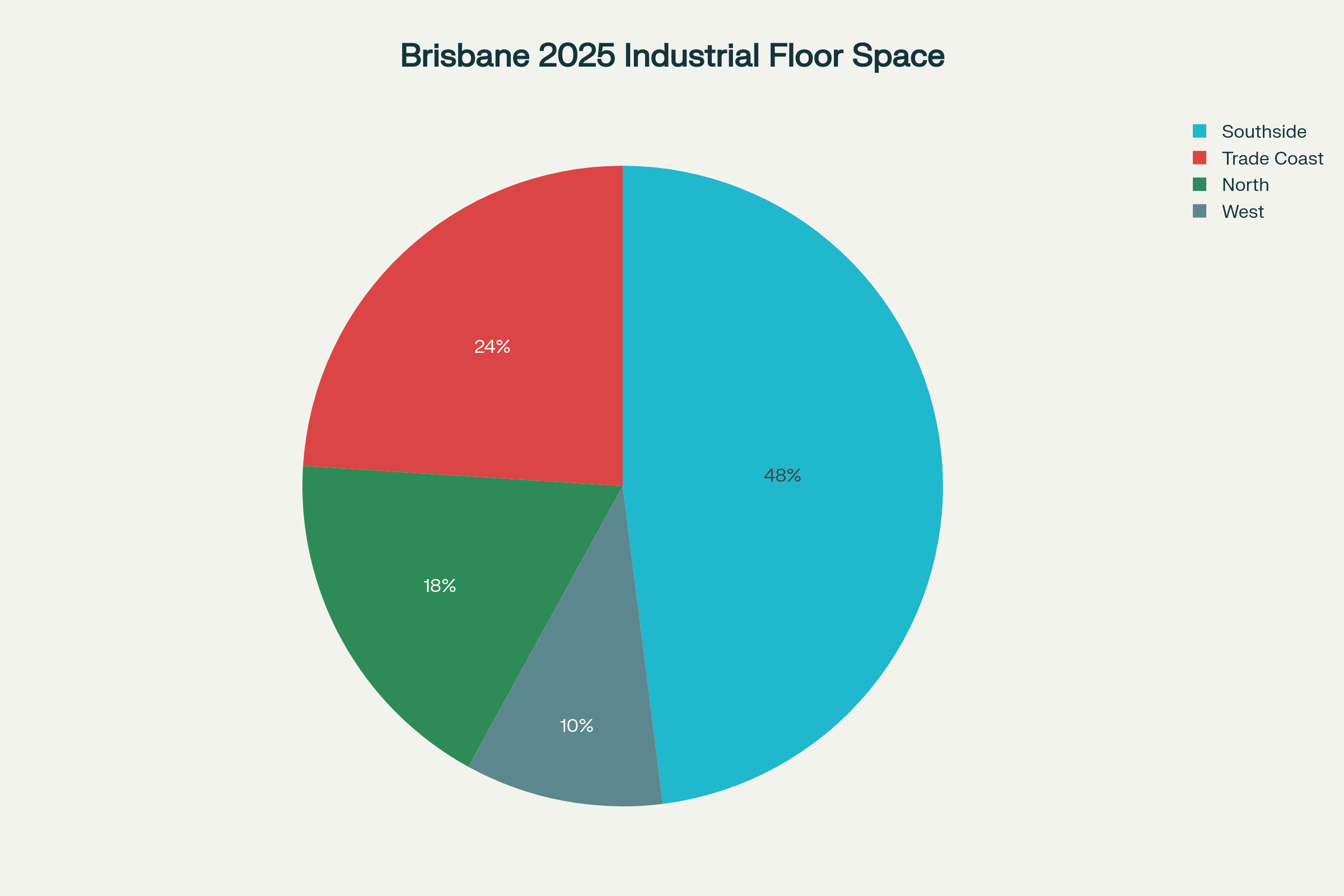

Development activity has moderated compared with “boom” years, but there’s still approximately 520,000 sqm of new industrial and commercial supply coming to market in 2025. Nearly half of all new supply—48%—is in the Southside, with Trade Coast (24%), North (18%), and West (10%) making up the rest. Vacancy rates have increased slightly, with the Southside at 6.7% due to recent large completions, yet demand for mid-sized and sub-3,000 sqm spaces remains strong and competitive.

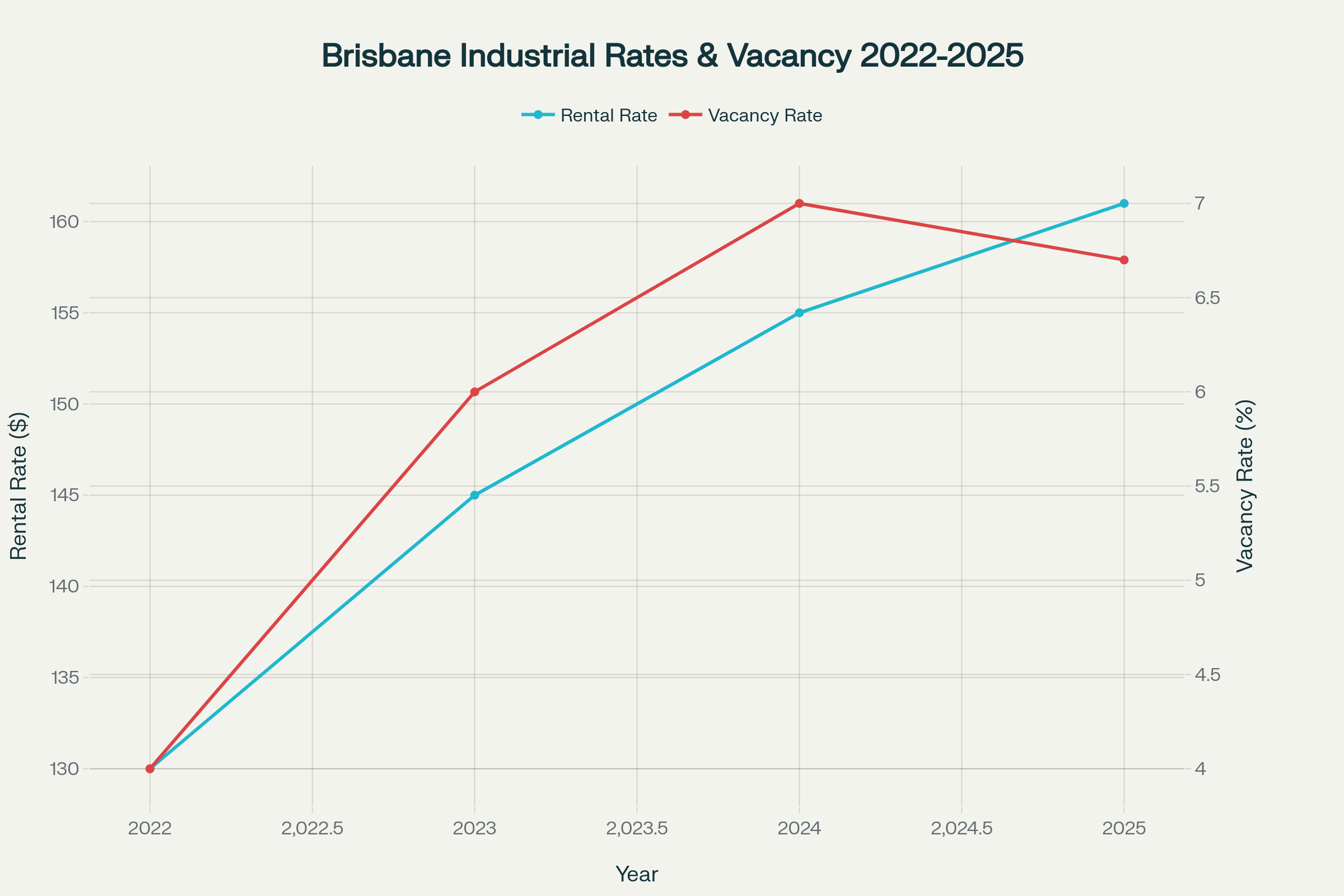

Rental growth continues, though at a gentler pace, with prime industrial rents averaging $161/sqm while secondary sits near $140/sqm. Incentives are trending up, reflecting supply, but land values remain steady at $580/sqm, underpinned by persistent demand from tenants and developers.

Retail & Office: Tight Listings Fuel Growth

On the retail front, supply remains tight—total listings in August were 11.6% lower than a year earlier, putting pressure on both prices and competition. The vacancy rate for Brisbane’s rental market is just 0.9%, holding steady at record lows. That’s kept gross yields firm at about 3.4% for houses and 4.4% for units. Retail trade volumes and property transaction momentum continue, buoyed by Brisbane’s population and resilient consumer confidence.

Market Outlook

Economic conditions support further expansion: Queensland’s GDP is forecast to grow 2.1% in 2025. With interest rates trimmed, both buyers and investors are coming off the sidelines—nearly $1 billion in industrial sales has already been transacted in H1 2025 with strong positive sentiment from lenders for Brisbane commercial property loans. Migration, major infrastructure projects, and a strong labour market are all working in Brisbane’s favour as we move into the final quarter.

For businesses considering commercial finance, partnering with specialists who understand these market shifts is critical. At Smart Business Plans, we broker commercial finance solutions that align with your unique property and business goals, leveraging access to over 60 lenders and structuring loans that support your growth plans—learn more about our commercial property loans and how we create tailored business plans and financial forecasts to position you for success.

I’m seeing plenty of opportunities—especially for those open to secondary locations or flexible timing on acquisitions—and am happy to discuss strategies for making the most of Brisbane’s shifting market.