Melbourne’s commercial property market is making a quiet but decisive comeback to September 2025, marked by improved sentiment across office, industrial, and retail commercial premises. Having watched the latest figures and spoken with clients throughout the year, I’m seeing three key trends define the city’s commercial landscape right now.

Office: Renewed Confidence and Lower Vacancies

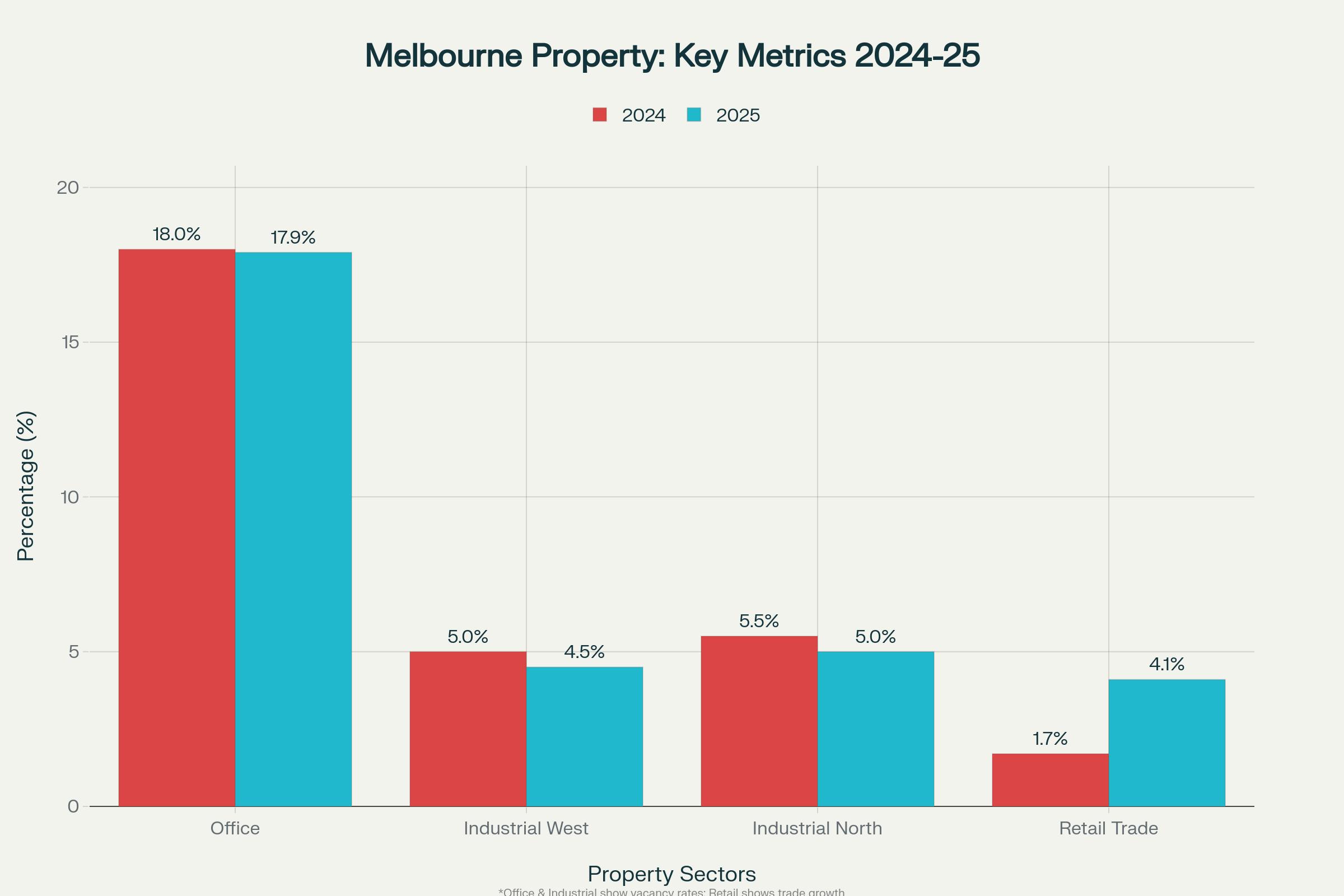

After years of high vacancy rates and subdued activity, Melbourne’s office sector is finally regaining momentum. In Q2 2025, office property sentiment jumped 21 points, marking the first major upward shift since 2022. Businesses are gaining confidence, with local and interstate investors beginning to re-engage, and tenants feeling more secure in expanding or securing new space. The CBD vacancy rate edged down from 18% to 17.9%, bucking the national trend and highlighting Melbourne’s resilience in the face of shifting work patterns.

Industrial: Balancing Supply, Demand, and Yields

Industrial leasing and investment activity has stabilised after the explosive growth of past cycles. About 600,000 sqm of new industrial supply is forecast for 2025 (less than last year’s 950,000 sqm) while vacancy rates have fallen slightly to around 4.5% in West Melbourne and 5% in North Melbourne. Average prime industrial yields now sit at 6.00%, with secondary yields at 6.75% as at March 2025. Investor appetite remains strong, particularly among private buyers, and tenant demand is being driven by manufacturing, transport, and logistics users in the North and West regions.

Retail: Resilient Sales and Investor Interest

Melbourne’s retail market has proven more robust than expected, supported by population growth, steady employment, and resilient trade activity. Retail trade in Victoria rose by 4.1% year-on-year to June 2025—well above last year’s 1.7% growth—and over $500 million in retail property changed hands in just the first half of 2025. Well-located neighbourhood centres and high-quality assets are attracting both local and offshore capital, while limited new supply is intensifying competition for top sites.

Outlook: Opportunity for Thoughtful Strategy

Looking ahead, I expect further rate cuts and stabilising yields to continue supporting Melbourne’s recovery. The return of investor confidence, ongoing migration-driven demand, and renewed commitment to prime assets should keep the city’s commercial property sector on a positive trajectory through late 2025. This will be supported by a continued positive sentiment towards Melbourne commercial real estate loans by lenders.

If you’d like to talk through what this means for your property strategy—whether as investor, landlord, or occupier—I’m always happy to share market insights tailored to your needs.

This update draws on the latest market research and practical expertise to bring the Melbourne market into clear focus, making it easy for your clients and readers to act on the latest opportunities. Let me know if you’d like a supporting visual or social post for further