As we move through September 2025, I’ve been closely watching how the Sydney commercial property market is evolving, and there are some important trends worth sharing. The market is shifting toward a more balanced, tenant-friendly environment—something I believe both business owner-occupiers and commercial property investors should pay close attention to.

Leasing Market: Tenants Are Gaining More Power

From what I’m seeing—and supported by the Sydney Industrial Property Market Review for August/September 2025—demand for larger industrial spaces (over 2,500 sqm) in Sydney has softened somewhat. Businesses are taking their time to make leasing decisions, reflecting a more cautious approach amid broader economic factors. It’s a marked change from the fast-paced urgency we’ve observed in recent years.

Despite this, headline rents for prime industrial properties have held steady, but landlords are clearly feeling the pressure. Incentives and flexible lease terms are becoming more common as competition to secure quality tenants heats up. This puts tenants in a stronger position to negotiate terms that suit their needs better than before.

Supporting this, the latest NAB Australian Commercial Property Survey highlights a trend toward increased tenant leverage in commercial leasing markets across Australia, including Sydney [Source: NAB Q2 2025 Survey].

Supply: More Options for Occupiers

Sydney’s industrial property stock is expanding, with a wave of new developments coming online alongside increased availability of secondary spaces. This growing supply gives tenants more choices, which further fuels the shift in leasing market dynamics.

For investors and landlords, this means it’s essential to differentiate their properties through tailored incentives and lease flexibility to attract occupiers in a more competitive market.

Investment Market: A More Cautious Outlook

From my discussions with investors, caution is the prevailing mood. Inflation concerns, interest rate fluctuations, and global economic uncertainty have made buyers take a more deliberate approach. While transaction volumes may be down, demand remains focused on high-quality industrial assets with strong tenant covenants and long lease terms.

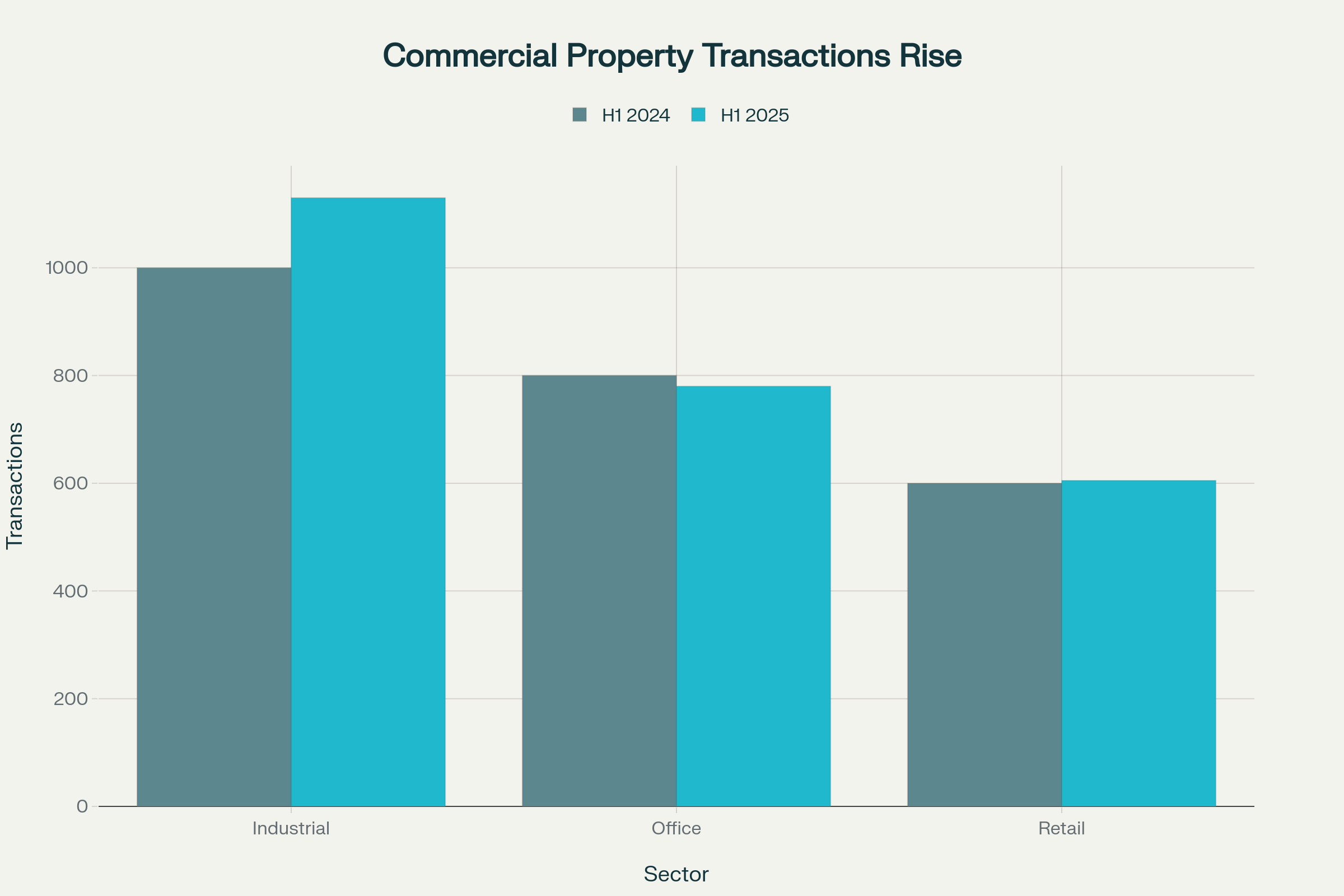

This aligns with data showing a 13% rise in overall commercial property transactions in H1 2025, driven mainly by industrial commercial property, but with more scrutiny on asset quality and location [Source: Property Markets News, July 2025].

What This Means Going Forward

Looking ahead, I expect the following to shape the market:

-

Increased leasing incentives as landlords compete for quality tenants.

-

Stable rents for prime spaces, but some softening in secondary markets.

-

Continued investor preference for core industrial assets with resilient tenant profiles.

-

Greater negotiating power for occupiers, especially in larger spaces.

- Lenders remaining positive for industrial real estate loans.

While the market is more cautious, I see real opportunities here. Whether you’re a tenant looking to lease or an investor considering a Sydney commercial property loan to acquire premises, understanding these market shifts will help you make better, more confident decisions.

If you want to talk through what these changes could mean for your commercial property loan strategy, don’t hesitate to reach out. I’m here to help navigate this dynamic market with you.