Home » Commercial Property Loans » Loan Types

Commercial Property Loan Types

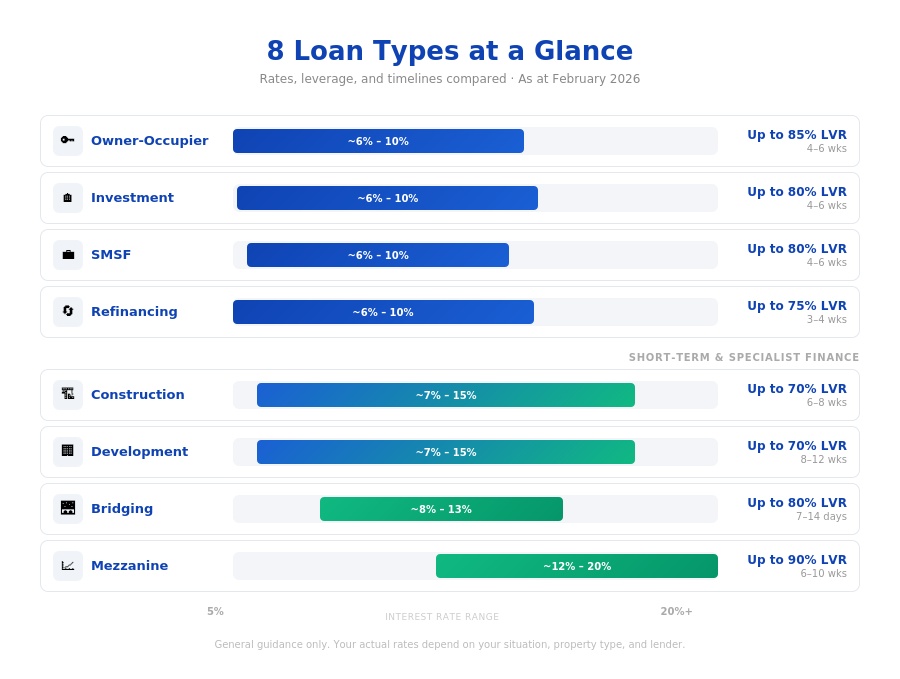

Compare the eight main types of commercial property loans available in Australia, each designed for a different situation.

Whether you’re buying business premises, building from scratch, using your super, or need fast settlement for an auction — the right loan type affects your rate, deposit and approval speed

Below we compare all eight options with current rates, LVRs and typical timelines.

Find the right commercial property loan type for you

Different types of commercial property loans are designed for different situations. Some lenders offer better rates for owner-occupiers, others provide higher leverage for developments, and specialist lenders have unique options like SMSF commercial property loans.

We’ll help you find the right lender and loan type for your needs. Compare all eight options below, or jump straight to what you need:

Quick Links:

- Buying property? → Commercial Property Investment Loans

- Buying business premises? → Owner-Occupier Loans

- Building or renovating? → Commercial Construction Loans

- Want better rates? → Refinance Commercial Loans

- Using your super? → SMSF Commercial Property Loans

The 8 Commercial Property Loan Types

Current rates, leverage, and timelines compared · As at 01 March 2026

Explore Each Loan Type

Tap into the details — features, benefits, and who each loan suits best.

Owner-Occupier Finance

Specialised finance for businesses buying their own premises with better rates than investment loans.

- Lowest commercial mortgage rates

- No rental income assessment needed

- Higher LVR options available

- Tax benefits of property ownership

Business owners who want to own rather than rent their premises, build equity, and control their operating costs.

Commercial Property Investment

Finance for investing in existing commercial properties — offices, warehouses, retail shops, and industrial sites.

- Fast approval (4–6 weeks typical)

- Established properties mean proven values

- Wide lender choice for competitive rates

- Owner-occupier rates available

Investors seeking established commercial properties with existing tenants to generate yield and capital growth.

SMSF Property Loans

Use your superannuation fund to buy commercial property with limited recourse borrowing and specialist compliance.

- Tax-effective property ownership

- Limited recourse borrowing structures

- SMSF compliance management

- Business premises purchase options

Business owners or investors wanting to own commercial premises through super, or trustees seeking tax-effective investment.

Construction Finance

Finance for building new commercial premises or major renovations with progress payments and specialist lenders.

- Progress payment structures

- Interest capitalisation during build

- End-value lending assessment

- Specialist construction lender networks

Businesses building custom premises, or investors developing new commercial properties with pre-committed tenants.

Development Finance

Finance for large-scale property developments, subdivisions, and multi-stage commercial projects.

- Higher leverage than traditional loans

- Private development funder access

- Profit share structures available

- Multi-stage project financing

Experienced developers undertaking major projects, multi-stage developments, or land acquisition plus construction.

Bridging Finance

Short-term funding when timing doesn't align — buying before selling, quick settlements, or auction purchases.

- Fast approval and settlement

- Interest-only payments available

- Private lender networks

- Auction purchase capability

Time-critical opportunities, auction purchases, or renovation funding before permanent finance is available.

Commercial Refinancing

Switch lenders for better rates or access equity from your property by comparing 60+ lenders.

- Often save 0.5–1% per year

- Access equity without selling

- Consolidate multiple loans

- Improve loan terms and features

Property owners wanting to reduce costs, access funds for growth, or consolidate multiple commercial loans.

Mezzanine Finance

High-leverage finance for major projects requiring more than traditional loans with access to private funders.

- Higher leverage than traditional loans

- Flexible repayment structures

- Equity participation options

- Family office and private funder access

Major developments, acquisitions requiring high leverage, complex deal structures, or growth capital for sophisticated projects.

All information is general guidance only. Your actual rates and terms may differ. Not financial advice. Please read our disclaimer in footer below.

How to Choose the Right Loan Type

Start with your timeline.

If you need settlement within two weeks, bridging finance is likely your only realistic option (we can then refinance you to a permanent loan once settled). If you have 4–6 weeks, the full range of loan types is available.

Consider your structure.

Business owners buying their own premises almost always get better rates as owner-occupiers than investors buying the same property. If you’re purchasing through a company or trust, the lender’s view of your application changes — and so do the rates.

Think about leverage.

Standard commercial loans typically cap out at 70% LVR. If your project needs more, mezzanine finance can take you higher, but at a significantly higher cost. The question is whether the project returns justify the additional interest expense.

Check your super.

If you have an SMSF with $400K+, running the numbers on an SMSF purchase versus a standard loan is worth the 30-minute conversation — the tax position can change the economics entirely.

Need help choosing the right loan?

Choosing the right loan and lender is where our expertise matters. We’ll model different scenarios to show you the real cost different between loan options.

Frequently asked questions

What types of commercial property loans are available in Australia?

We help Australian business owners and commercial property investors access the eight main types of commercial property loans:

- Commercial property purchase loans, which help you buy existing properties with competitive rates.

- Owner-occupier commercial property loans, which help business owners secure their own commercial premises.

- Commercial construction loans, which provide progressive drawdowns for building and renovating commercial properties.

- SMSF commercial property loans, which use limited recourse borrowing arrangements with up to 80% LVR.

- Commercial property development finance, which funds subdivision and multi-unit projects.

- Commercial property bridging loans, offering short-term commercial property transitions.

- Mezzanine finance tops up funding to 90% of project costs.

- Commercial property loan refinancing, which improves existing loan terms or accesses equity.

Each loan type serves different business objectives. Owner-occupiers typically use purchase or construction loans for their business premises. Investors often leverage SMSF or development finance structures for wealth building.

How do I choose between the different commercial property loan types?

Each of our commercial property loan types is designed to suit different needs and objectives. Choosing the right commercial loan type for you will depend on your immediate goals and long-term strategy. In our experience the final decision usually comes down to four key factors:

- How do you intend to use the commercial property (business premises or investment)?

- How much available capital do you have (deposit and costs)?

- What’s your timeline for securing finance (immediate purchase or future development)?

- What’s your exit strategy (long-term hold or short-term flip)?

For business owners buying premises, owner-occupier purchase loans offer the best rates and terms. Property investors typically choose between standard purchase loans for existing buildings or development finance for value-add projects. If you’re using super funds, SMSF commercial loans provide tax advantages despite slightly higher rates.

We often structure combinations – for example, bridging finance for quick settlement followed by permanent financing, or commercial construction loans that convert to standard mortgages upon completion. Call 1300 262 098 to ask our team about modeling different scenarios to show you the real costs and benefits of each option.

Can I combine multiple loan types for my commercial property?

Yes, we can help you strategically combine different commercial loan types to optimise your financing structure. Many of our clients arrange multi-tiered financing that maximises leverage, while managing risk and cost.

Common combinations we see include using mezzanine finance to top up a standard first mortgage to 85-90% LVR, or starting with bridging loans for speed then refinancing to permanent finance. For developments, you might use land purchase loans initially, then construction finance for building, finally converting to a commercial mortgage upon completion.

We also help clients use SMSF loans for part of the purchase while using conventional finance for the balance, maximising tax benefits while maintaining flexibility. The key is ensuring all facilities work together without cross-default provisions that could create problems later.

How do commercial property loan types differ for owner-occupiers versus investors?

Owner-occupier commercial property loans typically offer lower interest rates (0.5-1% less than investors only), as well as higher loan-to-value ratios (up to 80% LVR). Loan terms can also be longer (up to 30 years) because lenders view premises that will be occupied and used by the business owner themselves as lower risk. These loans include both commercial mortgages for purchase as well as construction finance for any custom-built facilities.

Investment commercial property loans typically focus on rental yield (which can be 6-8% for commercial properties). They usually require stronger serviceability calculations, and include specialised options like SMSF loans and mezzanine finance. Investors can also access property development finance for projects and bridging loans for opportunity purchases, though these carry higher rates due to increased risk.

What's the difference between bridging finance and mezzanine finance?

While both of these commercial loan types are designed to provide you with leverage, bridging finance and mezzanine finance serve different purposes. Bridging loans are short-term (typically 6-12 months) solutions for timing gaps – buying before selling, auction purchases, or covering deposits while arranging permanent finance. Rates are higher than standard commercial real estate loans, but you’re only paying for the short period needed.

Mezzanine finance however is designed to sit behind your first commercial mortgage, topping up funding to 85-95% of project costs. It’s typically used for developments or major acquisitions where you need maximum leverage. While more expensive, mezzanine funding enables deals that wouldn’t otherwise be possible.

We find bridging suits urgent opportunities or timing mismatches, while mezzanine works for experienced operators undertaking profitable projects who can handle the higher costs. Both require clear exit strategies which we can help you plan before proceeding.

How long does commercial property finance approval take?

Commercial property finance approval usually occurs within 4-6 weeks from application, though we can achieve much faster approvals for straightforward transactions that have complete documentation.

The timeline varies significantly based on loan complexity. Standard owner-occupier purchases with major banks average 4-5 weeks, while SMSF commercial property loans may take 5-6 weeks due to additional trust structures. Development finance typically requires 6-8 weeks given detailed feasibility assessments. Private lenders can move faster – often settling in 2-3 weeks when speed is critical.

What affects your timeline? Property valuations (3-7 days), legal documentation review (5-10 days), and lender due diligence processes all impact approval speed. Having complete financial statements, clear property details, and working with experienced brokers who know each lender’s requirements can reduce approval times by 30-40%.

Can I live in a commercial property?

Generally speaking, you cannot live in a commercial property as your primary residence due to zoning restrictions and council regulations. Commercial properties are usually zoned for business use, lacking residential certificates of occupancy, and are potentially missing essential residential safety requirements like proper fire exits, ventilation systems, and bathroom facilities that are needed under residential building codes.

However, some exceptions exist. Mixed-use properties with both commercial and residential zoning allow living above or behind your business – common with shop-top housing or live-work units. Caretaker accommodation within commercial buildings may be another exception.

Some of our clients have converted from commercial to residential, but have needed to get council approval, and in some cases rezoning. If you need both business premises and residence, consider purchasing a mixed-use property or separate residential property alongside your commercial property purchase. We can structure finance packages covering both properties, potentially using cross-collateralisation for better rates and higher LVRs.

Can I buy commercial property through a trust or company?

Yes, purchasing commercial property through a trust or company structure is not only possible but recommended for most commercial property investments. Most of our commercial property transactions involve entity purchases, providing the buyer with asset protection, tax optimisation, and estate planning benefits that far outweigh the slightly more complex lending requirements.

Company structures offer limited liability protection, potential tax rate advantages (25-30% company tax vs up to 47% personal), easier transfer of ownership through share sales, and clear separation of business and personal assets.

Trust structures (unit trusts or discretionary trusts) provide flexible income distribution to beneficiaries, asset protection from personal creditors, estate planning advantages, and potential land tax benefits.

SMSF structures combine retirement savings with property investment under specific regulatory frameworks.

The key is establishing structures before making offers, as changing purchaser names post-contract can trigger stamp duty issues. We work with specialist commercial property accountants and lawyers who can establish optimal structures while ensuring lending compliance.