Home » Commercial Property Australia – Tools, Guides & Expert Insights » First-Time Commercial Property Buyers Guide Australia

The Complete First-Time Commercial Property Buyers Guide For Australia

This guide is designed to be a comprehensive walk-through for first-time commercial property buyers in Australia.

I’ll cover the key differences between commercial and residential property, common mistakes to avoid, and what first-time commercial property buyers can expect through their journey.

About the Author

About the Author Nadine Connell is Co Founder of Smart Business Plans Australia, a leading commercial property loan finance broker. Nadine has helped over 3,300 Australian business owners and property investors over 15 years. Connect with Nadine on LinkedIn

Home » Commercial Property Australia – Tools, Guides & Expert Insights » First-Time Commercial Property Buyers Guide Australia

The Complete First-Time Commercial Property Buyers Guide For Australia

This guide is designed to be a comprehensive walk-through for first-time commercial property buyers in Australia.

I’ll cover the key differences between commercial and residential property, common mistakes to avoid, and what first-time commercial property buyers can expect through their journey.

About the Author

About the Author Nadine Connell is Co Founder of Smart Business Plans Australia, a leading commercial property loan finance broker. Nadine has helped over 3,300 Australian business owners and property investors over 15 years. Connect with Nadine on LinkedIn

I remember walking past the same shopfront every day for three years. Every morning, same routine: coffee, then past that corner building with the “For Lease” sign. Then one day, the sign changed to “For Sale,” and something clicked. That could be mine. Not just rented, but actually owned.

That’s often how it starts for first-time commercial property buyers. You’re running a business, paying rent month after month, and suddenly you realise there’s another way. Or perhaps you’ve been building equity in residential property and you’re ready to diversify into commercial. Maybe you’ve simply recognised that commercial property offers returns that residential can’t match.

Whatever brought you here, you’re in the right place. Over the past 15 years, I’ve helped hundreds of first-timers navigate their first commercial property purchase. This guide distils everything I’ve learnt from those deals into a practical roadmap you can actually follow.

Let’s get started.

Why First-Time Commercial Property Buyers Often Hesitate (And Why You Shouldn’t)

“Commercial property is only for the wealthy.”

I hear this one constantly. Last month, I helped a cafe owner in Brisbane purchase her first commercial property for $385,000. She’d been paying $4,200 a month in rent, convinced that property ownership was years away. Turns out, with the right commercial property purchase loan, her deposit requirement was less than she’d saved, and her mortgage repayments are actually lower than her rent was.

“The process is too complicated.”

It’s different from residential, sure. But complicated? Not really. It’s just unfamiliar. Once you understand the key differences (which we’ll cover), you’ll find commercial property transactions are often more straightforward than residential. No emotional buyers gazumping you at auctions, for starters.

“I don’t know where to start.”

Well, you’re reading this guide, so you’ve already started. And honestly? That’s the hardest part. Most first-time buyers spend months or even years thinking about it before they take action. The ones who succeed are simply the ones who move forward despite not knowing everything.

Here’s what you actually need to know before diving in.

The Four Things That Make Commercial Property Different

1. It’s All About the Income

When you buy a house, banks care about your income. When you buy commercial property, they care about the property’s income. This is actually brilliant news for first-timers because it means your personal income matters less than you think.

I worked with a young electrician last year who wanted to buy his workshop. His personal income was modest, but the workshop generated $72,000 annually in rental value. The bank approved his commercial property loan based primarily on that rental income, not his payslip.

2. Longer Leases, Better Returns

Residential leases? Typically 6-12 months, often with difficult tenants. Commercial leases? Usually 3-5 years minimum, often with annual rent increases built in. Your tenant is a business that needs stable premises and usually takes better care of the property than residential tenants. They have to. Their livelihood depends on it.

Plus, commercial yields are typically 5-8% compared to residential’s 3-4%. On a $500,000 property, that’s an extra $10,000-$20,000 per year in your pocket.

3. The Tenant Pays for (Almost) Everything

Most commercial leases are “net leases,” meaning the tenant pays for rates, insurance, and maintenance. In residential, you’re covering these costs. In commercial, you’re just collecting rent. This dramatically improves your cash flow and reduces your management headaches.

4. Valuations Are More Complex (But That’s Good)

Commercial valuations consider rental income, comparable sales, and potential returns. This means a property’s value isn’t just about location and square metres, it’s about income potential. For savvy buyers, this creates opportunities to add value that don’t exist in residential property.

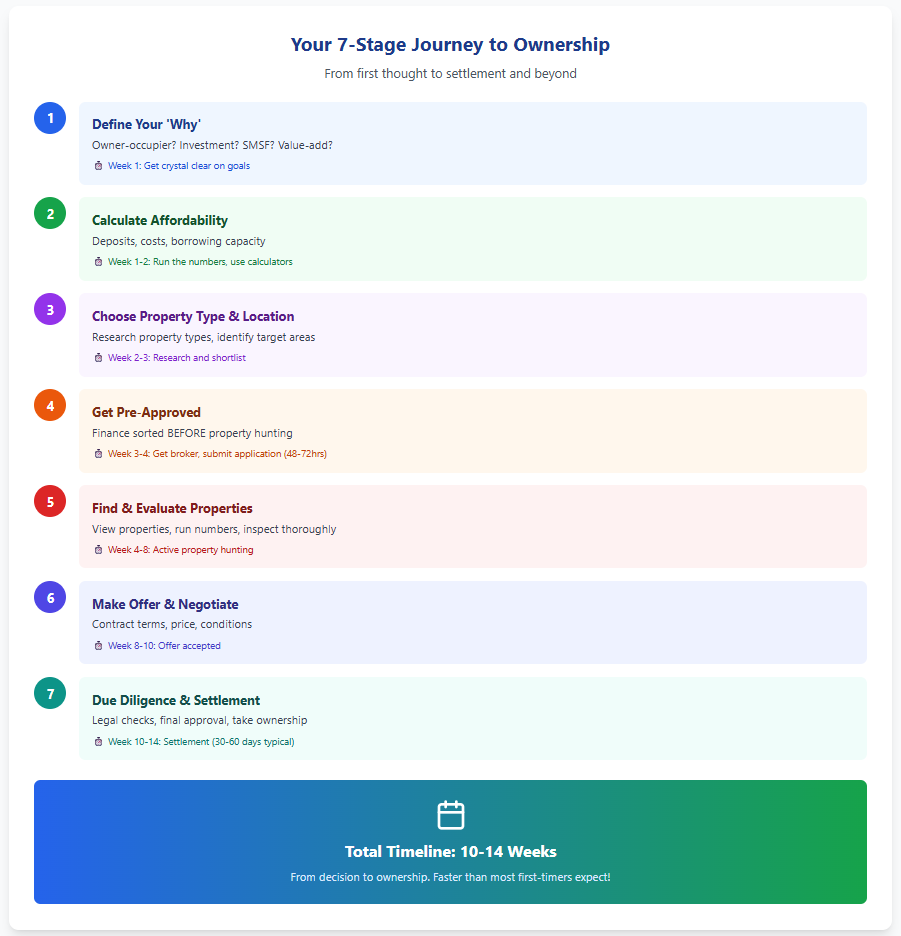

Your First-Time Commercial Property Buyers Journey: The 7 Stages

Let me walk you through exactly what happens from first thought to settlement. I’ve structured this around the seven distinct stages every first-timer goes through. Skip ahead if you’re already partway through, but I’d recommend reading all of it. The mistakes usually happen when people skip steps.

Stage 1: Getting Crystal Clear on Your ‘Why’

Before you look at a single property listing, you need to be brutally honest about why you’re buying commercial property. I’ve seen too many first-timers get caught up in the excitement and buy the wrong type of property for their actual goals.

Are you buying to:

Own Your Business Premises?

This is owner-occupier territory. You stop paying rent, build equity, and gain control over your business location. The maths here is compelling: if you’re paying $3,000/month rent, that’s $36,000/year building someone else’s wealth. With commercial property finance, your mortgage might cost the same or less, but you’re building equity instead.

Generate Investment Income?

You’re buying for the rental yield and capital growth. Different property types and locations suit this strategy. Generally, you want established tenants on long leases, stable areas, and property types with strong demand.

Develop or Value-Add?

This is advanced territory for a first-timer, but some people start here. You’re buying something that needs work, improvement, or redevelopment. Higher risk, potentially higher returns, and definitely requires different finance through development finance.

Build Wealth Through Your SMSF?

Buying commercial property through your self-managed super fund is a legitimate wealth-building strategy, but it comes with strict rules. You’ll need specialist SMSF commercial property loans and must follow ATO guidelines carefully.

Here’s a quick exercise I walk all my first-time clients through:

Your Goal | Best Property Type | Typical Budget Range |

|---|---|---|

Own business premises | Retail shop, small office, light industrial | $300K – $1.5M |

Investment income | Strata office, small retail, industrial unit | $400K – $2M |

SMSF purchase | Office, medical, small industrial | $500K – $2M |

Value-add opportunity | Vacant premises, dated buildings, subdivision potential | $300K – $1M |

Stage 2: Understanding What You Can Actually Afford

This is where dreams meet reality, and honestly, the reality is usually better than first-timers expect.

The Deposit Reality

Most first-timers think they need 30-40% deposit for commercial property. That’s often wrong. Yes, commercial deposits are higher than residential (where you might get away with 5-10%), but 20% is typically the sweet spot for commercial. On a $500,000 property, that’s $100,000, not $200,000.

Some lenders will even go to 80% LVR (Loan-to-Value Ratio), meaning just 20% deposit, if the deal is strong. I’ve arranged deals at 75% LVR many times for first-timers with solid business financials and good property picks.

Where Your Deposit Can Come From

You don’t need to have cash sitting in the bank. Here’s where I’ve seen first-time buyers source their deposits:

- Equity in existing residential property: This is huge. If you own a home with equity, you can often use that as security without selling.

- Business savings: Retained earnings from your business.

- Super funds: If buying through your SMSF.

- Family guarantee: Parents or family members using their property as additional security.

- Sale of assets: Shares, other investments, even vehicles or equipment in some cases.

Last year, I helped a couple buy a retail property using equity from their home (which was fully paid off) plus $40,000 cash. They didn’t need to sell their home or disrupt their lifestyle, just lodge a simple second mortgage over it.

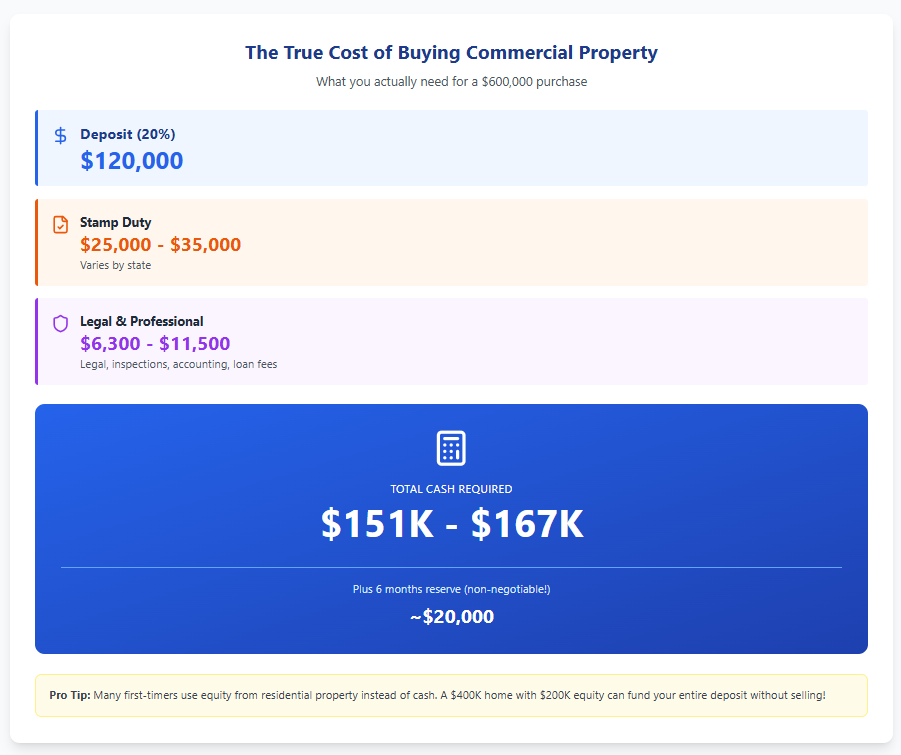

The Real Cost of Buying

Your deposit isn’t your only upfront cost. Here’s what a typical $600,000 commercial property purchase actually costs:

Cost Item | Typical Cost |

|---|---|

Deposit (20%) | $120,000 |

Stamp duty (varies by state) | $25,000 – $35,000 |

Legal fees | $3,000 – $5,000 |

Building & pest inspection | $800 – $1,500 |

Loan application/valuation fees | $1,000 – $2,000 |

Accounting/tax advice | $1,500 – $3,000 |

Total Cash Required | $151,300 – $166,500 |

Yes, stamp duty hurts. But remember, in most states, commercial stamp duty is actually lower (as a percentage) than residential. And if you’re buying as an owner-occupier, some states offer concessions.

Use our stamp duty calculator to get precise figures for your state and property value.

How Much Can You Borrow?

Commercial lending assessments look at different factors than residential loans. Here’s what actually matters:

- The property’s income (most important)

- Your business financials (if owner-occupier)

- Your personal financial position

- Your experience and business track record

- The property type and location

A good rule of thumb: if the property’s net rental income can cover the loan repayments with at least 20% buffer, you’re in strong territory. Our borrowing capacity calculator will give you a realistic estimate based on your specific situation.

Stage 3: Choosing the Right Property Type and Location

This is where first-timers often stumble. They either buy what they know (usually the wrong property type) or chase the highest yield (usually in the wrong location).

Property Types Explained for First-Timers

Retail (Shops, Showrooms)

- Entry level: $300K – $800K for smaller shops

- Yield: 5% – 7%

- Best for: Owner-occupiers, experienced landlords

Retail can be fantastic or terrible depending on location and tenant. High street shops with pedestrian traffic and long-term tenants are gold. Suburban shops in declining areas? Pass. We arrange finance for retail properties regularly, and location is everything.

Office (Strata Units, Small Buildings)

- Entry level: $250K – $600K for strata units

- Yield: 5% – 6.5%

- Best for: First-time investors, owner-occupiers

Office strata units are probably the most common first purchase I see. They’re like residential apartments but for businesses. Lower entry point, professional tenants, typically well-maintained buildings. Perfect first purchase.

Industrial (Warehouses, Factories, Storage)

- Entry level: $400K – $900K for small units

- Yield: 6% – 8%

- Best for: Investors comfortable with longer void periods

Industrial properties often offer the best yields, and tenants typically sign longer leases. The trade-off? If your tenant leaves, it might take longer to find a replacement. Still, we’re seeing strong demand for quality industrial properties in most markets.

Medical (Clinics, Consulting Rooms)

- Entry level: $350K – $750K for consulting rooms

- Yield: 5.5% – 7%

- Best for: Conservative investors seeking stable tenants

Medical tenants are generally excellent. They need specific fit-outs, sign longer leases, and rarely trash the premises. Medical properties also tend to hold value well during economic downturns. If you’re risk-averse, this is worth serious consideration.

Which One Is Right for You?

Here’s my honest take after doing this for years: your first commercial property should be either in a property type you understand deeply (because you work in that industry) or in a property type that’s so simple it doesn’t matter (like a simple warehouse with a long-term tenant).

Don’t try to be clever with your first purchase. Specialty properties like service stations or hotels can offer great returns, but they’re not first-timer territory.

Location: The Make-or-Break Decision

I’m not going to parrot “location, location, location” at you. But I will tell you this: location determines everything in commercial property. The tenant quality you attract, the rent you can charge, how quickly you can re-lease, and ultimately what the property is worth.

For investment commercial properties, I look for:

- Established commercial precincts (not new developments with mostly vacant premises)

- Good transport access and parking

- Mix of businesses (not reliant on one industry)

- Evidence of long-term tenants (stable area)

- Reasonable proximity to residential population

For owner-occupier commercial property purchases, you’re obviously constrained by where your business needs to be. But within that constraint, still look for:

- Visibility and access appropriate to your business type

- Sufficient parking for staff and customers

- Premises that won’t be too large if you need to lease part of it out

- Area zoning that won’t restrict your business operations

Last month, a first-timer asked me to help finance a retail shop in a small country town, three hours from the nearest city. The yield was 9%, which looked amazing. But the tenant was the only business of that type in town, the building was dated, and the lease was ending in 18 months. I steered him towards a Sydney suburban office instead at 6% yield. Less exciting, but he’ll still own it in 10 years when the country shop would likely be vacant.

Stage 4: Getting Your Finance Sorted (Before You Find the Property)

Here’s a mistake I see constantly: first-timers find the perfect property, make an offer, then try to organise finance. By the time they get approval (or don’t), the property’s sold to someone else.

Do this instead: get pre-assessed before you start seriously shopping.

Why Pre-Assessment Matters More in Commercial

With residential property, pre-assessment is helpful. With commercial property, it’s essential. Here’s why:

- Commercial sellers expect offers to be finance-ready

- Settlement periods are often shorter (30-60 days is common)

- You’re competing against experienced investors with finance already arranged

- It clarifies exactly what you can afford before you fall in love with something too expensive

What You Need to Get Pre-Assessed

I’ll be straight with you: commercial loan applications require more documentation than residential. Don’t let that intimidate you. It’s just paperwork.

For all applicants:

- Last 2 years’ personal tax returns

- Last 2 years’ business financial statements

- Recent BAS statements

- Current loan statements (if you have existing debt)

- Bank statements (usually 3-6 months)

- Identification documents

For the property:

- Indicative purchase price range

- Property type you’re considering

- Location preferences

Most of this is documentation you already have or can easily get from your accountant. The pre-qualification process typically takes 48-72 hours once we have everything.

Working With a Broker vs Direct to Bank

I’m obviously biased here (I’m a commercial finance broker), but let me give you the practical reality: commercial property loans are complex, and different lenders have vastly different appetites for different property types and borrower situations.

Going direct to your bank means you get one option. They’ll either approve you or decline you. Working with a broker means we assess your situation and approach the lenders most likely to approve your specific scenario at the best rates.

Last year, a first-timer came to me after his bank declined his application for an office property purchase. I placed the exact same application with a different lender and it was approved within a week at a better interest rate. The difference? Knowing which lenders prefer office properties and small business borrowers.

There’s no cost to you for using a broker (we’re paid by the lender), but you get access to our experience and lender panel. It’s honestly a no-brainer for first-timers.

Interest Rates and Loan Structures

Commercial property interest rates currently sit between 6.5% and 9.5%, depending on your situation and the lender. That’s higher than residential, but remember, you’re typically getting better yields to compensate.

Most first-timers ask whether to fix or go variable. My usual answer: split the difference. Fix part of your loan for certainty on repayments, keep part variable for flexibility and potential rate drops. It’s boring advice, but it’s boring because it works.

Loan terms typically range from 15 to 30 years. Longer terms mean lower repayments but more interest paid overall. Your choice here depends on your strategy. Investment property? Longer term to maximise cash flow. Owner-occupier? Maybe shorter term to build equity faster.

Stage 5: Finding and Evaluating Properties

Now the fun part starts. You’ve got pre-approval, you know your budget, you understand what type of property you want. Time to find it.

Where to Look

Commercial property isn’t advertised the same way residential is. You won’t find it all on Domain or realestate.com.au (though some is listed there). Here’s where to search:

- Commercial real estate websites: CommercialRealEstate.com.au, Commercial Real Estate, BusinessForSale

- Direct to commercial agents: Most commercial sales happen through specialised commercial agents. Build relationships with agents in your target area.

- Off-market opportunities: Some of the best deals never get advertised publicly. Agents keep them for their best clients (which you can become).

- Driving around: Old-school, but surprisingly effective for certain property types like retail shops.

A quick tip: when you contact commercial agents, be professional. Tell them you have pre-approval, you’re a serious buyer, and you know what you want. They’ll take you seriously and often bring you opportunities before they hit the market.

What to Look for in Property Listings

Commercial listings provide way more information than residential ones. Here’s how to read them:

“NAV” (Net Annual Value): This is the current annual rent. Multiply by 100 and divide by the purchase price to get the gross yield.

“Outgoings”: In most commercial leases, the tenant pays these, but you need to know what they are. If the tenant leaves, you’re paying them until you find a new tenant.

“Lease terms”: How long is left on the lease? When’s the next rent review? Are there options to extend?

“Zoning”: Critical if you’re an owner-occupier. Make sure the zoning allows your intended business use.

I once saved a first-timer from buying a property zoned for retail when he needed it for light manufacturing. The agent assured him it would be fine. It wasn’t. Always check zoning yourself or with your solicitor.

Evaluating the Investment Potential

Let me give you a simple framework I use to assess whether a commercial property is worth pursuing:

Question | Good Sign | Warning Sign |

|---|---|---|

Who’s the tenant? | Established business, professional operation | Startup, unprofessional, same owner as property |

How long left on lease? | 3+ years with options | Less than 2 years, no options |

What’s the condition? | Well-maintained, recent upgrades | Deferred maintenance, structural issues |

What’s nearby? | Other commercial properties, active businesses | Mostly vacant, declining area |

Why is it for sale? | Owner retiring, portfolio restructure | Tenant problems, development threats |

Use our investment property finance calculator to run the numbers on any property you’re seriously considering. It’ll show you the real return after all costs.

The Inspection: What to Actually Look At

I’ve been to hundreds of commercial property inspections. Here’s what actually matters:

First, forget the cosmetic stuff. Paint and carpet are irrelevant in commercial. You’re looking for:

- Structural integrity: Cracks in walls, sagging roof lines, water damage

- Building systems: Electrical, plumbing, HVAC (heating and cooling)

- Compliance: Fire safety, disabled access, building code compliance

- Parking and access: Is there enough? Is it fit for purpose?

- The lease fit-out: If buying with a tenant, what’s their fit-out like? Sometimes it’s valuable, sometimes it’s trash.

Always, always get a professional building inspection. Budget $800-$1,500 depending on the property size. It’s the best money you’ll spend. I’ve seen inspections save first-timers from $100,000+ in structural problems that weren’t obvious to the naked eye.

Stage 6: Making Your Offer and Negotiating

You’ve found a property you like. The numbers stack up. The inspection came back clean. Time to make an offer.

How Commercial Negotiations Differ

Commercial property negotiations are more straightforward than residential because everyone involved is treating it as a business transaction. There’s less emotion, more logic.

That said, commercial sellers expect certain things:

- You have finance pre-approval: Telling them you need to “check with the bank” kills your credibility.

- You can move quickly: If you need 90 days to settle, expect a lower offer to be preferred over yours.

- You’ve done your homework: Asking basic questions about the lease or property during negotiations suggests you’re not serious.

What to Offer

The eternal question. My approach: start below market, but not insultingly so. Commercial property sellers are typically more realistic than residential sellers, but they still want to feel like they won the negotiation.

If a property is listed at $600,000 and comparable sales suggest it’s worth $580,000-$590,000, I’d usually open at $560,000-$570,000. That gives room to negotiate up while still potentially securing a good deal.

Key Contract Terms to Negotiate

Price isn’t the only thing to negotiate. These terms matter just as much:

- Settlement period: Longer gives you more time to organise everything, but sellers prefer shorter.

- Deposit: Usually 10%, but sometimes negotiable.

- Conditions: Finance, building inspection, lease confirmation, council searches.

- Inclusions: Any equipment, fit-out, or extras included in the sale.

One term I always insist on for first-timers: a building and pest inspection condition. Yes, you might have already done an inspection, but having it as a contract condition means you can walk away if something major comes up.

Stage 7: Due Diligence, Settlement and Taking Ownership

Your offer is accepted. Congratulations! But you’re not done yet. Now comes due diligence, which in commercial property is more detailed than residential.

Due Diligence Checklist

Your solicitor will handle most of this, but you should understand what’s being checked:

Legal checks:

- Title search (who actually owns it, are there any encumbrances?)

- Zoning certificates (can you use it how you intend?)

- Planning restrictions (can you modify it?)

- Council rates and searches

Lease checks:

- Current lease document review

- Rent review mechanisms

- Outgoings reconciliation

- Tenant’s right to sublet or assign

- Make-good clauses at lease end

Financial checks:

- Actual rental income verification

- Outgoings for the past 2 years

- Any incentives given to tenant

- GST status of the sale

Here’s something most first-timers don’t realise: if the property has a GST-registered tenant, the sale might involve GST. This significantly affects how much you pay and how the contract is structured. Your solicitor will advise, but don’t skip this conversation. It’s important.

The Final Finance Approval

Your pre-qualification was conditional. Now the lender needs to formally approve based on the actual property. This involves:

- Professional valuation (lender arranges this)

- Lease document / contact of sale review

- Final assessment of all conditions

This usually takes 5-10 business days. Problems are rare at this stage if you’ve been upfront with your broker about the property details, but occasionally a valuation comes in lower than purchase price. If that happens, you either need to negotiate the price down, increase your deposit, or walk away (depending on your contract conditions).

Settlement Day

Settlement in commercial property is smoother than residential. It’s all done electronically between solicitors. You won’t get keys handed over in an office like in the movies.

On settlement day:

- Your loan funds are released

- The balance of purchase price is paid

- You become the registered owner

- Keys and building access are transferred

- You need to notify relevant bodies (council, insurance, etc.)

What Happens Immediately After Settlement

You own a commercial property. Now what?

If it’s an investment:

- Ensure insurance is in place (your lender will insist on this)

- Set up your rental income collection (usually direct to your bank)

- Establish a relationship with the tenant

- Set up accounting for the property (separate from your personal finances)

- Arrange professional property management if you’re not self-managing

If you’re an owner-occupier:

- Ensure insurance coverage

- Set up utilities in your business name

- Update your business address everywhere (Google, website, business cards, etc.)

- Notify your customers/clients of the permanent location

- Start building equity instead of paying rent!

The Money Stuff: Understanding Your Ongoing Costs and Returns

Let’s talk about the ongoing reality of commercial property ownership. This is where first-timers either fall in love with commercial property or realise they made a mistake. The difference? Usually, it’s whether they understood these numbers before buying.

Your Monthly Costs (Investment Property)

Using a $600,000 property with $480,000 loan at 7.5% over 25 years as an example:

Expense | Monthly Cost | Notes |

|---|---|---|

Loan repayment | $3,558 | Principal and interest |

Building insurance | $150 | Usually paid by tenant, but you pay if vacant |

Landlord insurance | $80 | Covers rent default, damage |

Accounting/tax | $125 | Annual cost divided monthly |

Property management (if used) | $300 | ~8% of rent (optional) |

Maintenance buffer | $200 | Even with tenant paying, set aside for big items |

Total Monthly Costs | $4,413 |

If your property generates $3,500/month in rent (6% yield), you’re running $913/month negative. That’s not necessarily bad. You’re building equity, getting tax deductions, and benefiting from capital growth. But you need to know these numbers going in.

Your Monthly Costs (Owner-Occupier)

Much simpler:

- Loan repayment (same $3,558)

- Building insurance ($150)

- Council rates ($200, varies by location)

- Utilities (~$300, depends on business type)

- Maintenance ($200 buffer)

Total: ~$4,408/month

But remember, you were probably paying $3,000-$4,000/month in rent before. Now you’re building equity and getting tax deductions on the interest and depreciation.

Tax Deductions You Can Claim

This is where commercial property gets really interesting. Talk to your accountant, but generally you can claim:

- Loan interest (often your biggest deduction)

- Building depreciation

- Fit-out depreciation

- All operating expenses

- Professional fees (accounting, legal, property management)

- Insurance premiums

- Repairs and maintenance

- Travel to inspect the property (if investment)

For an owner-occupier, the deductions are even better because you can also claim rent you’re effectively paying yourself.

The First-Time Commercial Property Buyers Mistakes To Avoid

I’ve watched hundreds of first-timers go through this process. Here are the mistakes I see repeatedly, and how to avoid them.

Mistake 1: Falling in Love With a Property

This is the emotional trap. You find a property, you love it, you convince yourself the numbers work even when they don’t.

Solution: Run every property through our investment calculator before making an offer. If the numbers don’t work, walk away. There will always be another property.

Mistake 2: Ignoring the Lease

The lease is the property in commercial real estate. A great building with a bad lease is a terrible investment. A basic building with an excellent long-term tenant at market rent is gold.

Solution: Have your solicitor review the lease thoroughly. Pay particular attention to: lease term remaining, rent review mechanism, outgoings responsibilities, any unusual clauses.

Mistake 3: Overpaying for Location

Yes, location matters. But paying a premium for A-grade location while getting a C-grade return doesn’t make sense unless you have a specific strategy.

Solution: Buy the best property you can afford in a B-grade location rather than a mediocre property in an A-grade location. You’ll get better returns and still have security.

Mistake 4: Buying Without a Buffer

Every first-timer thinks “the tenant will never leave” and “nothing will need repairs.” Then the tenant gives notice, or the roof needs replacing, or the air conditioning dies.

Solution: Have at least 6 months of loan repayments in reserve before you buy. Yes, that’s on top of your deposit and purchase costs. Non-negotiable.

Mistake 5: Ignoring the Numbers in Favour of “Potential”

“But it could be worth $X if I do Y” is how first-timers lose money. Value-adding is great. But buy on today’s numbers, not tomorrow’s dreams.

Solution: Only buy on current income and current value. If there’s upside potential, treat that as a bonus, not the reason you’re buying.

Your First 90 Days as a Commercial Property Owner

You’ve settled. The property is yours. Now what?

Days 1-30: Get Everything Set Up

- Introduce yourself to the tenant (if investment)

- Set up a separate bank account for the property

- Establish automatic rent collection

- Set up a system for tracking expenses

- Get your accountant to create the property as a separate entity in your books

- Take detailed photos of everything (you’ll need these for depreciation and insurance)

Days 31-60: Understand Your Property

- Review the lease in detail (again)

- Understand the outgoings and when they’re paid

- Check all insurance is adequate

- Understand the building systems (where’s the electrical board, water shut-off, etc.)

- Meet any body corporate or building manager (if strata property)

- Drive past regularly to keep an eye on everything

Days 61-90: Plan Ahead

- Mark key dates in your calendar (lease expiry, rent reviews, insurance renewals)

- Consider what improvements might add value

- Start thinking about your long-term strategy

- Review your loan structure with your broker

- Meet with your accountant about tax planning

When Things Go Wrong (And How to Handle It)

Not every commercial property purchase goes smoothly. Here’s what to do when problems arise.

The Tenant Gives Notice

This is your biggest risk. In residential, finding a new tenant takes days. In commercial, it can take months.

First, don’t panic. You have options:

- Negotiate with the existing tenant: Often they’ll stay if terms are adjusted

- Start marketing immediately: List the property before the tenant leaves

- Consider incentives: Rent-free periods, fit-out contributions, longer lease terms

- Be flexible: Sometimes adjusting the lease structure attracts better tenants

Most importantly, make sure you have that 6-month buffer I mentioned. This is exactly what it’s for.

The Valuation Comes in Low

Your lender’s valuation is $50,000 less than your purchase price. Now what?

Options:

- Renegotiate the purchase price (use the valuation as leverage)

- Increase your deposit to compensate

- Find a different lender (some value more aggressively)

- Walk away if your contract has a finance condition

I’ve navigated this situation dozens of times. Usually, a combination of a small price reduction plus a slightly higher deposit solves it.

Unexpected Expenses Arise

The building needs $20,000 of repairs you didn’t anticipate. This happens.

This is why we insisted on:

- Building inspection before purchase

- Cash buffer after settlement

- Maintenance reserve in your monthly budget

If you followed that advice, you’re fine. If you didn’t, you might need to negotiate payment terms with contractors or tap into other resources.

Your Next Steps: The Practical Action Plan

If you’ve read this far, you’re serious about buying your first commercial property. Here’s your exact next-steps checklist:

This Week:

- Clarify your goal (owner-occupier vs investment)

- Calculate your available deposit and buffer funds

- Use our borrowing capacity calculator to understand your budget

- Research property types in your price range

- Identify 3-5 target suburbs or commercial precincts

This Month:

- Get finance pre-approval (speak with us about commercial property investment loans)

- Engage a commercial solicitor

- Start viewing properties

- Build relationships with commercial agents

- Use our investment calculator on potential properties

Within 3 Months:

- Make offers on suitable properties

- Complete due diligence on accepted offer

- Finalise finance approval

- Prepare for settlement

- Plan your first 90 days as an owner

Final Thoughts From Someone Who’s Been There

I’ll be honest with you. Your first commercial property purchase is daunting. There’s a lot to learn, a lot to organise, and a lot that can go wrong. But here’s the thing: thousands of Australians do this successfully every year. Many of them knew less than you do right now.

The secret isn’t being the smartest person or having the most money. The secret is taking action despite uncertainty, surrounding yourself with good advisers (solicitor, accountant, broker), and being thorough without being paralysed.

I mentioned at the start that I remember walking past that shopfront every day. What I didn’t mention was that it took me another six months to actually make an offer. Six months of “I need to learn more first” and “I’m not quite ready.” That shopfront sold to someone else. I bought my first commercial property a year later. It was fine, but it wasn’t as good as that shopfront would have been.

Don’t let perfect be the enemy of good. Find a decent property at a fair price with acceptable terms, and make it happen. You can find a perfect property as your second commercial purchase.

Ready to Get Started?

We’ve helped hundreds of first-time buyers secure their first commercial property. Our process is straightforward: we assess your situation, match you with the right lenders, and guide you through to settlement.

Book a free consultation to discuss your commercial property plans. We’ll assess your borrowing capacity, explain your options, and help you understand exactly what you can afford.

Call us on 1300 262 098 to speak with a commercial property specialist today.

Use our tools to start understanding the numbers:

- Borrowing Capacity Calculator

- Stamp Duty Calculator

- Investment Property Calculator

Or call 1300 262 098 and our team would be happy to walk you through the process step-by-step.

Your first commercial property is closer than you think :>

This guide is for general information only and doesn’t constitute financial advice. Speak with qualified professionals about your specific situation.