“Should I buy commercial property now?” is the question I keep getting asked since the RBA‘s latest rate decision, and it’s one I’ve answered many times across multiple rate cycles during my 15+ years as a specialist commercial finance broker.

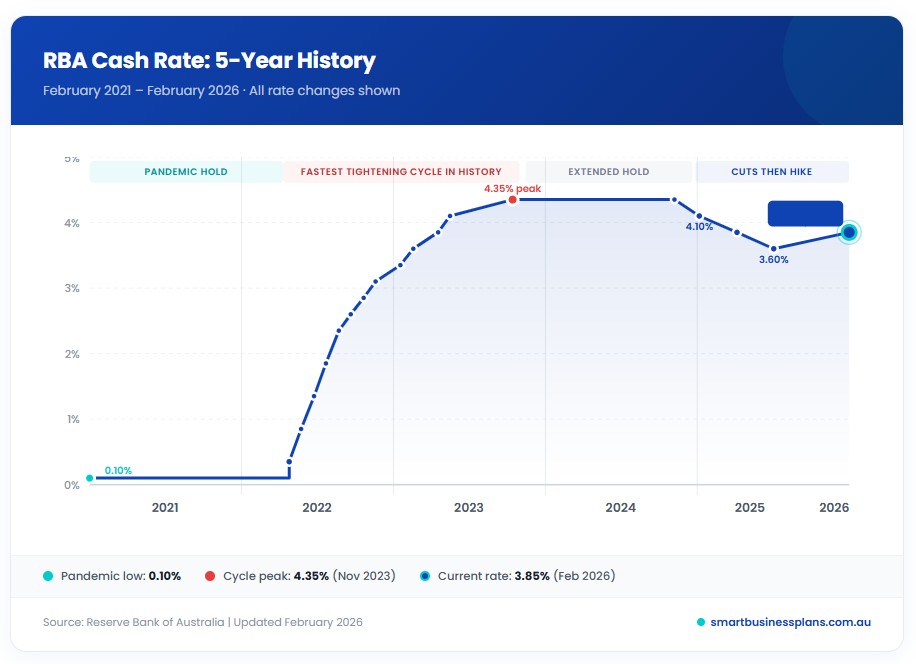

As at February 2026 the RBA cash rate currently sits at 3.85%. Here’s what it means for commercial property buyers.

The short answer? It depends on your business plan, not the cash rate. But I know that’s not particularly helpful on its own, so let me walk you through what I’m actually seeing in the market right now, what the numbers really look like, and the framework I use with my own clients when they’re weighing up this decision.

What happened with the latest RBA decision

The RBA Board voted unanimously to increase the cash rate by 25 basis points to 3.85% at its February 2026 meeting. It was the first rate increase since November 2023, and it came after headline inflation rose to 3.8% in the year to December 2025.

Governor Michele Bullock was direct in her post-meeting press conference, stating that the Board is uncomfortable with inflation at its current level. The decision partially reversed the three modest rate cuts delivered through 2025.

What’s important to understand is that this move was widely expected. Financial markets and all four major banks had priced in this hike well before the February meeting. As a result, the commercial loan interest rates available from our panel of 60+ lenders today aren’t dramatically different from what we were seeing in late 2025.

Further hikes remain a possibility. NAB is forecasting another 25 basis point increase in May if March quarter inflation data comes in hot. On the other hand, some economists argue that Australia’s surging dollar, which has climbed to around US$0.70 and hit 3½-year highs, could act as a natural brake on inflation by making imports cheaper. If that plays out, the February hike may well be the peak.

Nobody knows for certain. And that uncertainty is precisely why I tell my clients to base their purchase decision on their business fundamentals, not rate predictions.

The real cost of a 0.25% rate increase on a commercial loan

Let’s look at the actual numbers, because they’re far less dramatic than the headlines suggest.

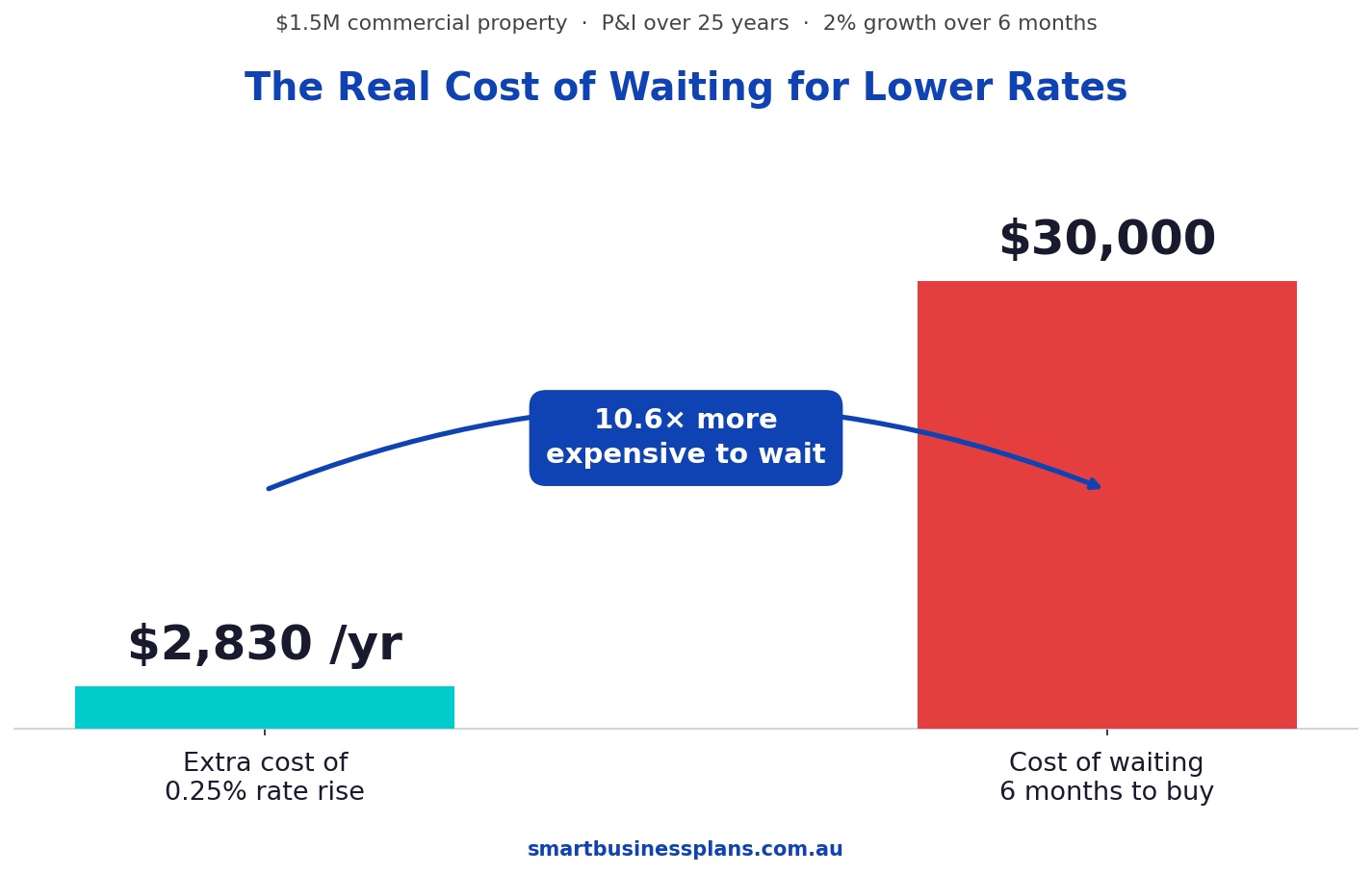

On a $1.5 million commercial property loan at a typical rate of 6.50% over a 25-year principal and interest term, a 0.25% rate increase adds approximately $236 per month to your repayments. Over a full year, that’s roughly $2,830.

If you’re on an interest-only arrangement, which is common for investors, the monthly increase is around $312 per month, or approximately $3,750 per year.

Those numbers matter, of course. Every dollar counts when you’re running a business. However, they need to be weighed against what happens on the other side of the equation if you delay your purchase.

Why waiting often costs more than the rate increase itself

Here’s the pattern I’ve seen consistently across every rate cycle in my career.

Commercial property values in most Australian markets don’t stand still while buyers wait for the “perfect” interest rate environment. Commercial rents are rising in most capital cities right now, with Brisbane and Adelaide seeing particularly strong growth. Knight Frank’s chief economist has noted that these rent increases are expected to continue into 2026, driven by limited new supply and rising construction costs.

Consider this scenario. You’re looking at a $1.5 million commercial property. You decide to wait six months for rates to (hopefully) come down. During those six months, the property appreciates by just 2%. That’s $30,000 added to the purchase price, plus additional stamp duty calculated on that higher amount.

Now compare that to the annual cost of the rate increase: approximately $2,830 on a P&I loan, or $3,750 on interest-only.

Put simply, a single modest rate movement costs you roughly $3,000 per year in additional repayments. Meanwhile, six months of property price growth could cost you $30,000 or more upfront. In my experience, the math over the past 15 years has overwhelmingly favoured buying when your circumstances are right, rather than trying to time the rate cycle.

What I’m actually seeing from lenders right now

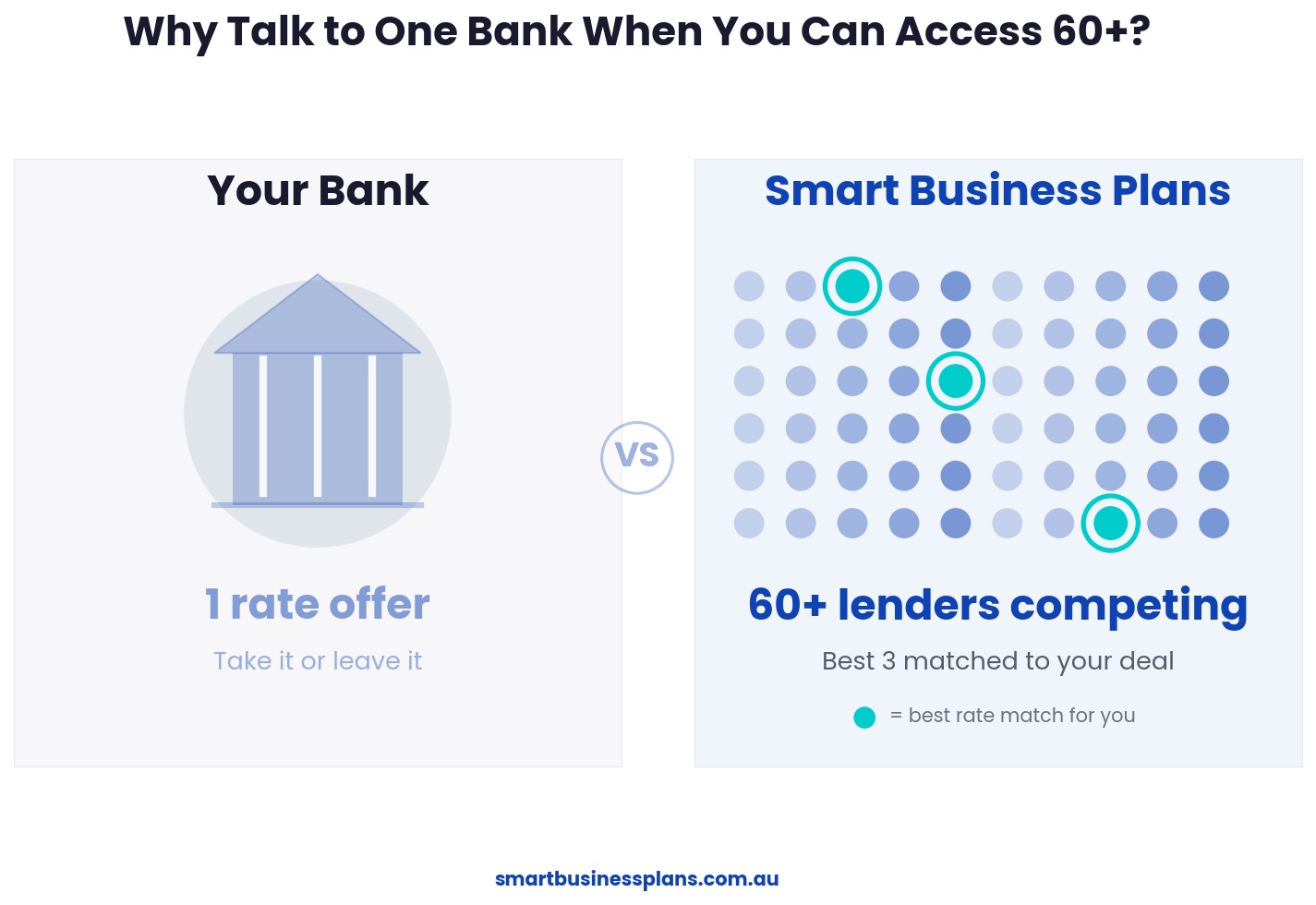

At Smart Business Plans, we work with a panel of 60+ specialist commercial lenders, including the big four banks, regional banks, non-bank lenders and specialist financiers.

Here’s what the lending market looks like in 2026:

Lender appetite remains strong. Despite the rate increase, commercial lenders are actively competing for quality deals. Several lenders on our panel have sharpened their pricing in recent weeks to attract new business. Competition among lenders generally works in your favour as a borrower.

Rates vary more by lender than by cash rate movement. Current commercial property loan rates start from 5.95%+ depending on loan type, LVR, property type and borrower profile. Owner-occupier rates sit at 5.95% – 10.05%, while investment rates range from 6.10% – 10.20%. The difference between the cheapest and most expensive lender on our panel for the same deal can be 1.5% or more. That’s six times the impact of a 0.25% cash rate increase. This is precisely why working with a specialist broker who can compare across the full market matters more than any single RBA decision.

Serviceability assessments haven’t tightened dramatically. While some lenders have adjusted their buffer rates, the overall lending environment for well-prepared applicants remains favourable. In particular, business owners with strong cash flow and a solid business plan are finding approval straightforward, often within 28 days.

The strong Australian dollar is helping buyers. With the dollar sitting near 3½-year highs, imported building materials, equipment and fit-out supplies are cheaper. If you’re buying a property that needs renovation or conversion for your business, your project budget goes further than it would have 12 months ago.

The rent vs buy equation hasn’t changed

If you’re a business owner currently renting your premises, the fundamental maths of the rent vs buy decision remains compelling, even at 3.85%.

Let’s say you’re paying $5,000 per month in rent. That’s $60,000 per year going towards your landlord’s mortgage, not yours. Over five years, that’s $300,000 with nothing to show for it. Over ten years, assuming modest annual rent increases of 3-4%, you’ll have paid well over $700,000.

Meanwhile, a significant portion of each loan repayment goes towards principal reduction, building equity in an asset you own. The interest component is also tax deductible for business purposes.

I sat down with a client last month who’d been paying $72,000 a year in rent for seven years. That’s over $500,000 in rent paid, and they own nothing. When we ran the numbers on purchasing their premises with an owner-occupier loan starting from 5.95%, the monthly difference was less than they expected, and they’d be building equity from day one.

The latest rate hike added roughly $236 per month to a typical $1.5M loan repayment. It didn’t fundamentally change the long-term equation. You’re still building equity instead of paying someone else’s mortgage.

For a detailed comparison based on your specific numbers, take a look at our commercial property buy vs rent calculator.

Five questions to ask yourself instead of “will rates go down?”

Rather than trying to predict where the RBA will move next, I encourage my clients to focus on what they can actually control. If you’re considering buying commercial property, these are the questions that matter far more than the cash rate.

1. Can your business comfortably service the loan repayments?

This is the most important question. Look at your cash flow over the last 12-24 months. If your business can service the repayments at current rates with a reasonable buffer, the timing conversation becomes secondary. Lenders typically require deposits from 30% for standard commercial loans, with LVRs up to 70% considered standard.

2. How long do you plan to occupy or hold the property?

Commercial property is a long-term play. If you’re planning to stay for five years or more, short-term rate fluctuations become far less significant. The longer your time horizon, the less any single RBA decision matters to your overall outcome.

3. What’s happening with your current lease?

If your lease is coming up for renewal, you may be facing a rent increase anyway. I’ve seen plenty of cases where the new lease terms made buying a more attractive option, even at higher interest rates. This is particularly common right now with commercial rents rising across most Australian markets.

4. Is there a suitable property available right now?

Good commercial properties in the right location, at the right price, with the right zoning don’t come along every day. If you’ve found one that ticks your boxes, waiting for a rate cut and risking losing it to another buyer carries its own cost. In my experience, this is the factor most often underestimated.

5. Have you explored the full lender market?

Many business owners only speak to their bank. With 60+ commercial lenders in our Australian lending marketplace, the rate and terms you’ve been quoted may not be the best available. I regularly see cases where a client is declined by one lender and approved by another for the same deal, sometimes at a better rate. Different lenders use different serviceability models, and that variety works in your favour when you have someone comparing across the full market.

The strong dollar wildcard

One factor worth watching closely is the Australian dollar. It’s been climbing steadily, supported by the interest rate differential between Australia and the US. While the US Federal Reserve has been cutting rates, Australia has been holding or hiking, making our currency more attractive to international investors.

Some economists argue this strong dollar could do the RBA’s inflation-fighting work naturally, by making imported goods cheaper and putting downward pressure on prices across the board. If that proves correct, the latest rate hike may well be the peak of this cycle.

For those seeking commercial property construction loans, a strong dollar has a direct practical benefit: imported construction materials, fixtures, equipment and technology cost less. If your purchase involves any renovation or fit-out work, your dollar literally goes further right now.

Whether the strong-dollar thesis plays out or not, it reinforces the point that making decisions based on your business fundamentals tends to produce better outcomes than waiting for macroeconomic conditions to align perfectly. They rarely do.

How to put yourself in the strongest position

If you’ve decided the timing is right for your business, here’s how to give yourself the best chance of a smooth approval and competitive terms.

Get your financials in order. Lenders want to see at least two years of business financial statements, tax returns and BAS. Clean, well-organised financials make a significant difference to both approval speed and the rate you’re offered.

Have a business plan and cash flow forecast prepared. This is where most applicants fall short, and it’s one of the key things that sets our service apart. At Smart Business Plans, we prepare detailed business plans and cash flow forecasts at no extra cost as part of our broking service. These documents demonstrate to lenders that you’ve thought carefully about serviceability and that the purchase makes sound commercial sense. It’s one of the main reasons our approval rate sits above market average for qualified applications.

Understand your borrowing capacity across multiple lenders. Different lenders use different serviceability models. We regularly see cases where a client can access 20-30% more borrowing capacity simply by matching their application to the right lender. Loan terms range from 1 - 30 years, and the right structure can make a substantial difference to your cash flow.

Consider your loan structure carefully. Principal and interest, interest-only periods, fixed vs variable, offset accounts, split loans. The right structure can save you thousands annually. These details often matter more than the headline cash rate.

Don’t rush, but don’t stall either. Take the time to do proper due diligence on the property, get independent valuations, and ensure the purchase aligns with your business strategy. But don’t let rate uncertainty paralyse you into inaction. The market typically doesn’t wait.

The bottom line

Should you buy commercial property now? The honest answer is: it depends on your specific business plan, not on what the RBA does next.

What I can say with confidence, after helping more than 3,300 Australian business owners arrange over $550 million in commercial property finance since 2009, is this: the businesses that achieve the best outcomes are those that make decisions based on their cash flow, their growth plans, their lease position and their long-term strategy. Trying to ‘beat’ the rate cycle almost always costs more than it saves.

The latest rate movement added roughly $236 per month to repayments on a typical $1.5 million commercial loan. That’s real money. But it’s a fraction of what six months of property price growth, a missed opportunity, or another year of rent payments could cost you.

If you’re weighing up a commercial property purchase, I’d welcome the chance to run the numbers on your specific situation. With access to 60+ specialist lenders and business plans prepared at no extra cost, we find solutions where others see obstacles.

Talk to us about your commercial property finance needs →

Or call us directly on 1300 262 098 for a confidential chat about your situation.